Planning For Early Retirement: Quick Guide to Reach the Goal

Planning For Early Retirement: Quick Guide to Reach the Goal

Posted Date: June 6th, 2023

Life is more than just having a job to pay the bills, isn’t it? Similarly, having a contingency fund as well as performing a regular job shouldn’t be prerequisites for obtaining financial freedom. This is all about having the life you’ve ever wanted and deserved without worrying about your monthly salary and associated expenses. Nevertheless, the majority of people fail to understand the importance of achieving financial freedom because they are so consumed with living their daily lives.

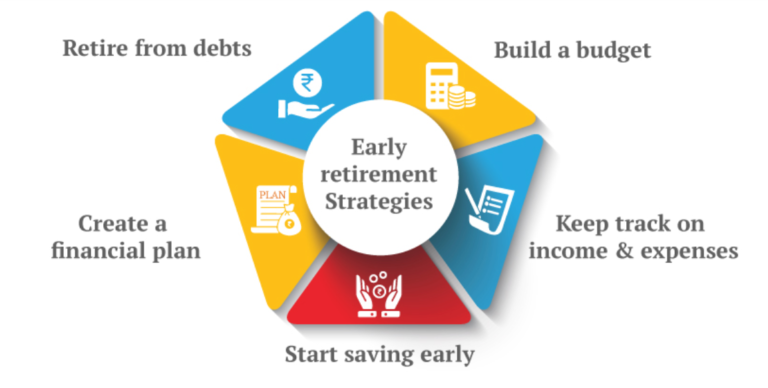

Even if many individuals make good money, they nevertheless rely on their pay checks to exist. They do not save and invest enough to achieve long-term financial independence. If you do not want to join them, these are the eight steps you need to do to retire early with financial independence:

- Estimated Retirement Budget

You must first solve it in order to go there, isn’t that, right? Thus, in order to retire early, you must first figure out the amount of cash you would have to accumulate in order to enjoy a comfortable and worry-free retirement. Throughout the duration of your retirement, you must determine your living expenditures, healthcare costs, and other expenses.

Considering that the median life expectancy is roughly 70 years and that you plan to retire by the time you are 45, you must figure out the entire amount you will require over the next 25 years. Inflation, which would drive up living expenses in the future, is another factor that must be taken into account in order to determine the precise amount you will require after you retire.

- Setting a budget now will save you money later.

You would have to make some compromises now if you wanted to retire sooner and have the life you wanted. Thus, if you can cut back on your spending now and save that extra money, you may invest it wisely in the future strategy, you may use the power of exacerbating to create a strong retirement portfolio.

- Repaying debt as quickly as feasible

The interest component chews up a significant amount of the same as your portfolio’s debt grows. To focus on increasing your wealth portfolio, you should ideally pay off your debts as fast as you can, especially high-interest ones like credit card debt. You must live modestly in your early years in order to reach early retirement order to accomplish F.I.R.E. (financial independence and retire early).

- Get health insurance right away.

If you are currently using one, that is terrific. If not, do so as soon as possible. Health insurance cannot be negotiated, especially if you are still working after retirement Revenue will cease. Your healthcare costs will inevitably increase due to the high medical inflation rate. In reality, the cost of out-of-pocket medical spending drives 50–60 million Indians toward poverty each year without health insurance.

However, obtaining health insurance after retirement may be challenging, particularly if you have got any pre-existing conditions. So, choosing an elevated health insurance policy is crucial to protecting your cash and developing a sound retirement plan.

- Make intelligent investments in assets that will enable you to build money.

To achieve your retirement objective, you must participate in investment products that will generate a greater return in your own future while maintaining your asset allocation & risk profile in mind.

- Create a SIP

Choose one systematic investment plan (SIP) to help you reach your retirement objectives. Little measures done in the right direction, if carefully planned and meticulously carried out, will undoubtedly help you reach your goal on schedule.

- Have a plan and follow it

Lastly, sticking to the plan is all that matters; this is the secret to preparing for an early retirement lifestyle. To avoid forgetting or wasting time performing the same thing, you could automate your investments. This necessitates that you prepare your whole investment process in advance, maintain an emergency fund, and then Just adhere to it exactly.

- Choose a term insurance policy.

This is your family’s backup plan and safety net. Hence, assuming you survive to your anticipated retirement age, you would have amassed sufficient savings. But if you don’t, this term life insurance plan will assist you in meeting your financial obligations to your family, if any. Making a few little sacrifices now will enable you to live the life you want.

End Note

Living the life, you desire and deserve without worrying about your monthly income and associated expenses is financial freedom, but many individuals do not understand the significance of investing & saving enough money to achieve long-term financial independence. Eight steps must be performed in order to achieve it, including budgeting, settling debts as fast as possible, investing intelligently, and determining the amount of money required to retire early. Choose one term insurance policy, invest wisely, establish a strategy, and stick to it, automate your investments, and get healthcare coverage right now.

Related Posts

Top Posts

Latest Post

Stay Informed

Sing up to stay update with Business, Lifestyle, Entertainment, and Many More.